My Ownership Challenge

As an ambitious associate veterinarian, I faced a common dilemma: I wanted to build wealth through practice ownership, but the traditional pathways seemed out of reach. Practice valuations had skyrocketed, making it nearly impossible to secure financing that made financial sense. That’s when I discovered an innovative approach that changed my career trajectory – a private equity-inspired “carry structure” that allowed me to become an equity partner without a significant cash investment.

If you are interested in learning more about this model after reading the article, you can find an interview I did with Built To Sell Podcast here.

Both Perspectives

As an Ambitious Associate:

- Financial Barrier: Current practice valuations made securing financing virtually impossible at terms that made financial sense

- Upfront Capital: I lacked sufficient savings for a meaningful down payment on even a minority stake

- Debt Burden: Traditional buy-ins would have created an unsustainable debt load given typical associate compensation

- Return on Investment: The risk-adjusted return on a heavily financed buy-in was questionable at best

For the Existing Owners:

- Value Protection: They weren’t willing to sell at discounted rates that diminished the value they’d built

- Succession Planning: They needed leadership succession for eventual retirement

- Corporate Competition: They were receiving competitive offers from corporate consolidators

- Transition Timeline: They wanted a gradual transition rather than an immediate exit

The hard truth was that I couldn’t afford to match what corporate buyers were paying, and the practice owners wanted to maintain the value they’d built while still creating a path for veterinary ownership. We needed a creative solution that worked for everyone.

My Solution

At the heart of our carry structure were three key principles designed to balance protecting existing value while creating powerful incentives for future growth:

Core Mechanics

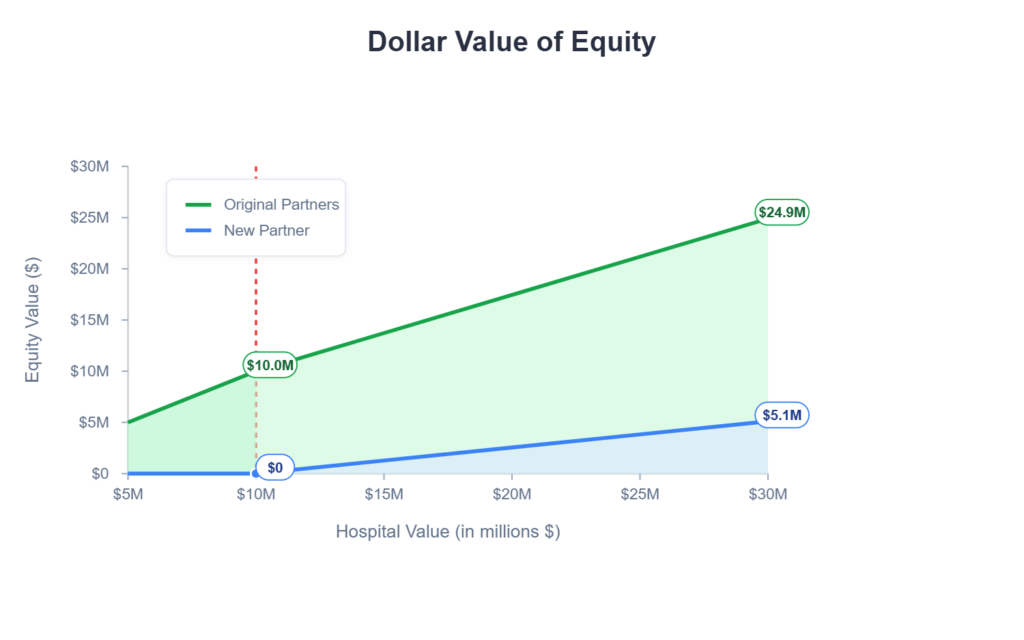

- Value Protection Threshold: We established a $10 million baseline that fully protected the owners’ existing equity value. This threshold, based on actual corporate offers, ensured that what they had already built would remain 100% theirs regardless of future developments.

- Growth Incentive Mechanism: I received a substantial 25.5% stake in all value created above the threshold. This created powerful incentives for me to help drive practice growth beyond its current valuation, aligning my financial success directly with practice growth.

- Dual Equity Class System: We created separate equity classes that addressed both:

- Liquidity Event Equity: Determining how proceeds would be distributed during a practice sale or buyout. This also served as the voting class of shares.

- Operational Equity: Governing annual profit distributions while we continued to operate the practice. This class t

How This Played Out

The practice had three existing partners with ownership stakes of approximately 50%, 35%, and 15%. We established a $10 million threshold based on real offers received from corporate buyers.

This meant:

- The existing partners retained 100% of the first $10 million of practice value

- I would receive 25.5% of any value created beyond that baseline

- No upfront capital investment was required from me

Benefits for Everyone Involved

For the Existing Partners:

- Protection of their current practice value

- Addition of motivated leadership without discounting their equity

- Significant value appreciation through our combined efforts

- Clear succession path without requiring immediate full exit

For Me as the New Partner:

- Path to meaningful equity ownership without significant capital

- Alignment of compensation with value creation

- Opportunity for leadership development early in my career

- Accelerated wealth building compared to remaining an associate

Who This Model Works Best For

- Early-career veterinarian seeking wealth-building opportunities without significant capital

- Practice owners looking for succession planning without immediate exit

- Multi-doctor practices with growth potential

- Practices with owners at different career stages

Conclusion

This innovative approach to veterinary practice ownership addressed the realities of today’s market. By protecting existing equity while incentivizing new leadership, this model created a pathway to ownership that benefited all parties involved. As practice valuations continue to evolve, creative approaches like this will be essential to maintaining veterinarian ownership in our profession.

About the Author: I implemented this approach at Old Brown Dog Veterinary Partners, where it successfully aligned incentives between existing owners and myself as a new partner without requiring significant upfront capital investment. If you are interested in learning more, leave a comment below with the questions you have. Reach out on LinkedIn if you want to discuss the details